Learn more Junior ISA 150 Invest from 1 to 9000 tax year 202122. Premium Bonds can be bought via the National Savings and Investments website NSI a government-owned bank.

Buying Premium Bonds Easiest Way To Purchase Bonds Online By Phone By Post Or As A Gift Lovemoney Com

You can also invest far more in ISAs than in premium bonds which have a maximum holding limit of 50000.

Are premium bonds an isa. NSI Premium Bonds are a savings account you can put money into and take out when you want where the effective interest paid is decided by a monthly prize draw. An equal chance to win up to 1 million each month. ISAs are a useful way to grow your money through saving or investments.

See our Premium Bonds guide for full details. Premium bonds are a savings product from National Savings Investments NSI which offer the chance of winning between 25 and 1m each month instead of paying interest. So any potential winnings are added to your general income for the year and taxed at the scale rates of tax of up to 48 in Andalucía.

In essence Premium Bonds and the potential winnings act like an ISA. ISAs pay interest annually up to a tax free allowance currently set at 20000. Thats before interest and is well above the 30000 maximum holding in Premium Bonds.

It was found that those who invested in a stocks and shares Junior Isa could typically expect to leave their child two to three times better off according to analysis by. Premium bonds require a minimum investment of just 25 and allow you to invest up to 50000. Of course you might think that its too much hassle spreading your cash around multiple accounts for minimal returns.

The Cash ISA limit is 20000 and thats shared with Stocks and Shares ISAs so Premium Bonds can work out as the most tax-efficient way to have cash savings. There are other tax-free benefits out there The personal savings allowance means that basic-rate taxpayers can earn 1000 in tax-free interest a year so the tax-free advantage of premium bonds is no longer unique. Lets start by simply using the Premium Bond prize fund rate of 1 even though as explained already most people wont win that much.

Your money is backed by HM Treasury so even though you dont earn interest what you put in wont go down. Other tax-free savings We have other tax-free savings accounts you can hold as well as an ISA. However if you live in Spain your premium bonds are not tax-free.

Parents who either invest or save towards their childs future via a Junior Isa rather than Premium Bonds will likely leave a child much better off new research suggests. Its a major reason why 12million savers hold cash Isas and plough around 38billion into them every year. Overall theres no answer to whether ISAs or bonds are best for you because it will largely depend on your individual circumstances.

What if you fancy your chances. Youll also receive no interest as the interest accrued on bonds goes towards the prize fund. Ultimately what you choose to invest in is your choice ISAs and bonds come with different pros and cons.

ISAs too are fully taxable in Spain in the hands of Spanish residents at the. Parents who either invest or save towards their childs future via a Junior Isa rather than Premium Bonds will likely leave a child much better off new research suggests. If you want a regular income Premium Bonds may not be the best option for you - you may be better off looking at different types of investment or savings accounts including isas.

Find out more about Premium Bonds. How premium bonds vs ISA investments compare. ISAs whether cash stocks and shares or junior offers tax-free interest provided that one doesnt exceed the 20000.

Three-fifths of the 1 billion put into to Junior Isas in 201920 sit in cash accounts. As an alternative to a cash ISA premium bonds dont offer much in the way of guaranteed growth because they do not pay any interest. Learn more A winning gift Aunties uncles family friends.

When Premium Bonds are bought the money goes into the Premium Bond fund. NSI says the chance of winning the 1m jackpot over the course of a year or 12 monthly prize draws is one in 41219096 if you have 100 in. An ISA can offer long-term financial stability Unlike premium bonds the value of shares can rise or fall.

However for many people premium bonds are a lifelong investment. Each 1 you invest in premium bonds is given a unique number. If it comes to the question of an ISA or premium bonds which way should you lean.

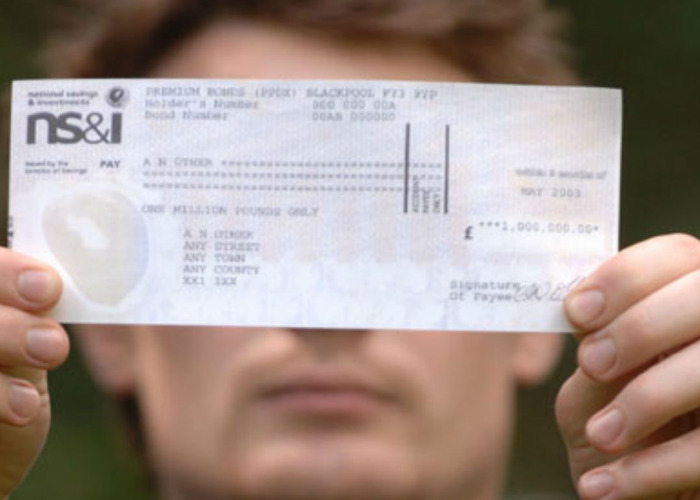

However with premium bonds as with a fixed rate ISA you can cash them in whenever you want. As its a lottery there is a chance. Our Premium Bonds give you the chance to win cash prizes from 25 up to 1 million in our monthly prize draw.

Learn more Investment Account 001 Invest from 20 to 1 million. They are not something I. You buy bonds which are each worth 1 and which each has an equal chance of winning so the more you buy the more your chances improve.

Advantages of Premium Bonds. Any adult can buy Premium Bonds for a child under 16. Lets face it premium bonds are nothing more than a lottery whereby Ernie short for E lectronic R andom N umber I ndicator E quipment selects random numbers that get compared to the serial numbers of bonds in.

And you might not be wrong there. It is the only bank in the UK that is backed by the HM Treasury. The interest on the HTB cash ISA is higher than I would get elsewhere although still not overly generous however up to 12k Ill get a 25 bonus if I use it to buy a house so potentially up to 3k free from the government.

This is compared to just 4000 had the money been invested in Premium Bonds during the same period. All investments into Premium Bonds are tax free. As a Spanish resident premium bond winnings are taxed as general income.

So which is best. You can invest from as little as 25. Lockheart Sun 11-Jul-21 143839.

If youre a lucky winner you wont have to pay a penny in tax on your prize. Premium bonds in the UK have a low average rate of return and you may earn more with a fixed-rate savings account or fixed-rate ISA. I have a combination of a HTB cash ISA Premium Bonds and SS ISAs.

You need to work out exactly what you want weigh up the pros and cons and get financial advice before making your choice. Yet money made from Premium Bonds like cash ISAs is always tax-free and does not count towards the personal savings allowance so its almost like an extra allowance. All the numbers are put into a monthly draw to win tax-free cash prizes.

Premium Bonds 100 annual prize fund rate Invest from 25 to 50000. ISAs or premium bonds.

Not Tradingis A Trading Decision Wall Art Print Ready To Hang Canvas Money Quotes Motivational Wall Art Motivation Wall

Komentar