However you are not likely to receive 1 - the fund is skewed because of the very few million-pound prizes. However a bond may not offer as compelling a potential return on.

Moneybox Application On Iphone Personal Financial Management Investing App

Money apps online banking and contactless payments.

Are bonds better than isa. However it is possible to have both a fixed rate bond and a fixed rate cash ISA account and hold savings in both but you must remember that you can only subscribe to one new cash ISA in a financial year. Although fixed rate bonds in 2021 still generally offer better interest rates than ordinary savings accounts the reward for locking your money away for a longer period is not as big as it used to be. This is Money repeatedly hears tales from readers whove held bonds for years and never won too.

If you have a sizeable chunk of savings that is likely to earn more than your personal savings allowance then youll pay tax on the profits made from your. Mathematically they are a good option but in real life if you need the capital guaranteed a cash ISA is the safer option. Economy now over 10 years old and talk of a pullback many are more concerned with protecting the money they have than with growing.

By now youre probably wondering which is best and that will largely depend upon the amount you wish to put away and your personal savings allowance. Whereas all you need do with the cash is foist the unwanted savings account back on to the bank. So really I think Premium Bonds only become worth a look for most people if you need to have more than 17800 in easy-access savings.

Are they better than savings. Subject to the risks noted above if such an account is paying more than an easy-access option it may be a way to get. They are similar in some ways but they are different products ISA and bonds differ in as much as with an ISA you have access to your savings whereas with a bond you do not.

ISAs are tax-free savings accounts that allow you to save up to 20000 tax-free per year. A fixed-rate ISA is one way to use your tax-free allowance in a year. When you compare ISA fixed-rate bonds together at least you have the peace of mind of knowing how much your investment will be worth upon maturity.

A stocks and shares ISA is a simple and tax-efficient way to grow your money over the long-term. If you are confident that you wont need access to your savings in the medium term a fixed-rate bond may offer a higher rate of return than an instant-access cash ISA. You usually have to pay capital gains tax on any profit you make on your investments.

The interest on the HTB cash ISA is higher than I would get elsewhere although still not overly generous however up to 12k Ill get a 25 bonus if I use it to buy a house so potentially up to 3k free from the government. The odds of winning with Family Building Society are 1 in 714 each month or 1 in 60 per year. You can invest up to 20000 each financial year and any growth in the value of your money and any income can build up protected within your tax-free wrapper.

Over the last decade the stock market has returned a feeble 06 vs. Parents who either invest or save towards their childs future via a Junior Isa rather than Premium Bonds will likely leave a child much better off new research suggests. The Premium Bond rate is currently higher than almost all savings rates except for one-year fixed savings and two-year fixed cash ISAs but the prize rates almost irrelevant to what you actually win so the question still stands.

The riskiest of all is the stocks and shares ISA and high yield bonds. Should I move cash to Premium Bonds or savings. Lockheart Sun 11-Jul-21 143839.

In light of this there has been a lot of questioning recently about the relative attractiveness of shares versus bonds. ISAs allow you to access your money. BoE base rate could make a difference THE BANK of Englands decision to increase its base rate may leave Britons wondering whether they will be better.

The overriding benefit of. Junior Isas vs Premium Bonds. At first glance fixed rate bonds seem better than ISAs by virtue of their higher rates but this isnt always the whole story.

Family Building Society says that the odds of winning at least 1000 with 10000 Premium Bonds are one in 357 per year. But theyre not for everyone so to answer the question of whether its better for you to invest in a savings account or a Premium Bond it all depends on what you want from the product that houses your savings. With the bull market in the US.

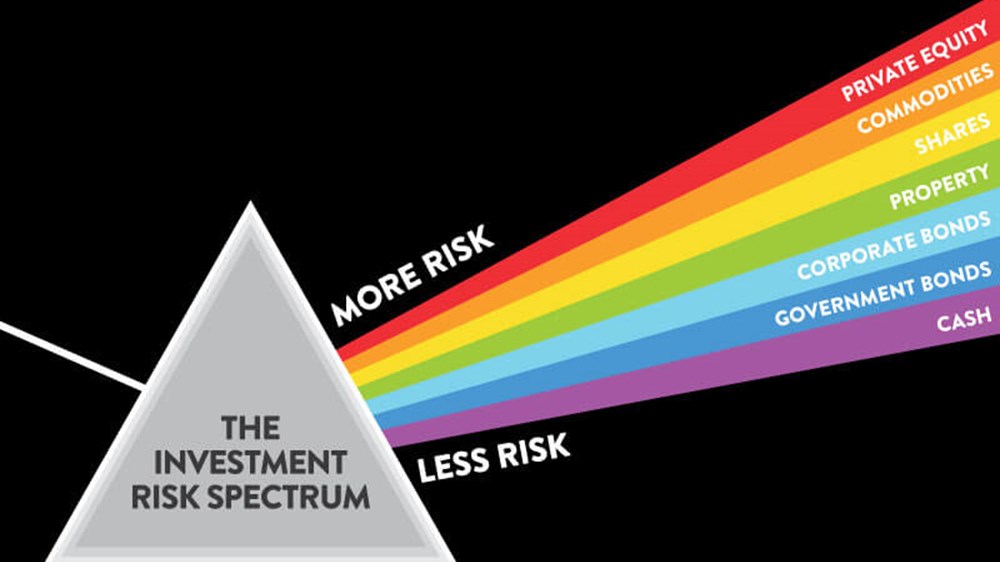

Premium bonds have an implied a rate of 1 which on the face of it it is probably better than most cash ISAs. 39 for Gilts and 16 for corporate bonds and bonds have now matched or bettered stock returns over more than 30 years. Then there is a bond which is a little more of a risk than a cash ISA but less risky than an investment ISA although there are different risks attached to different types of bonds.

After fees this gives the equivalent interest rate on the full 10k. While the best fixed-term bond rate currently offers a better return by 035 its important to remember that money saved into a bond wont be tax-free. The savings bond is essentially the same as the outmoded gilt.

I have a combination of a HTB cash ISA Premium Bonds and SS ISAs. Individual Savings Accounts ISAs work in much the same way as normal savings accounts but you dont pay any tax on the interest you make. Bonds vs Isas - Infogram.

Premium Bonds are arguably one of the nations favourite places to squirrel away savings and their attraction only seems to be growing. Except that on the bond market youve already taken that capital loss quicker than you can say Bond Apocalypse. But its much less than youll get on the best instant access Isas this year.

Update 16321- the upper limit on the balance you can earn interest on with the Chip1 account has been increased from 5000 to 10000. Youll take a 3 loss if you stick with it. Why long term tax-free investing likely to be a better option than chasing the 1m jackpot over 18 years.

The odds of winning a big prize are significantly better than with Premium Bonds. Fixed rate bonds provide a guaranteed rate of return as long as you lock your money away for a set period of time. Yes its tax-free.

Are Bonds Less Risky Than Shares Wealthify Com

Komentar