The second issuance of preferred shares took place from April 25 to May 10 2002. Awareness of environmental and social issues has certainly increased in recent years.

4 Best Performing Stocks And Shares Isas In 2022 Asktraders

Unlike the other ISAs in this review Triodos offers direct investments into its own actively managed funds rather than a portfolio of funds.

Ethical stocks and shares isa 2018. There are a range of ethical ISA options- whether you want to invest your money into cash stocks and shares or for your children. An innovative finance ISA sometimes called an IFISA is an ISA that contains peer-to-peer loans instead of cash in a bank or stocks and shares in companies. Start your ethical investing with an Healthy Investment Ethical stocks and shares ISA today with just a one off investment of 500 or 25 per month.

The investments are chosen for you with investments starting from 1. Bloom Energy BE San Jose-based renewable energy firm Bloom Energy delivers reliable clean sustainable electricity to organisations worldwide. Any interest that you make from a cash ISA alongside any returns from a stocks and shares ISA are free from tax up to the annual limit of 20000.

Triodos is an ethical bank that offers a cash ISA junior ISA and Stocks and Shares ISA. If youd invested your full 20000 that year you may have been up 2600. Wealthify is an app-based investment platform where you can choose between five investment styles depending on your attitude to risk and whether you want to go for ethical funds.

They do this by excluding certain companies and industries from its underlying investments such as gambling or tobacco production companies. A truly ethical investment - none of your investment will go to companies in the alcohol tobacco arms and gambling industries or companies that make products that have been tested on animals. Ethical ISAs The Ethical Investor ISAs ISAs allow consumers to save up to 20000 per tax year with all earnings from these tax free.

Remember you have until 5th April to use your annual savings allowance. There are several approaches to ethical investing with. These types of ISAs are at risk and not protected by the FSCS.

Heres a quick guide to help you understand how they work. Thats wildly different from a Cash ISA which would have made you at best 350 if you had the best interest rate of 175. You can invest up to the full amount of 20000 into either a Stocks Shares ISA Cash ISA or an Innovative Finance ISA.

Cash ISA Stocks Shares ISA. Ethical investing is an umbrella term for all approaches to investing that consider values as well as returns. Information on the fund is below.

The term also covers issues including but not limited to climate change workers rights gender equality arms tobacco and gambling when selecting companies and other assets. We offer FCA regulated independent financial advice to help you choose from a range of carefully selected sustainable investments and create your ethical ISA. Put it all in a cash ISA all in a Stocks Shares ISA or split the allowance between the two in any combination you like as long as you only open one of each type of ISA each tax year.

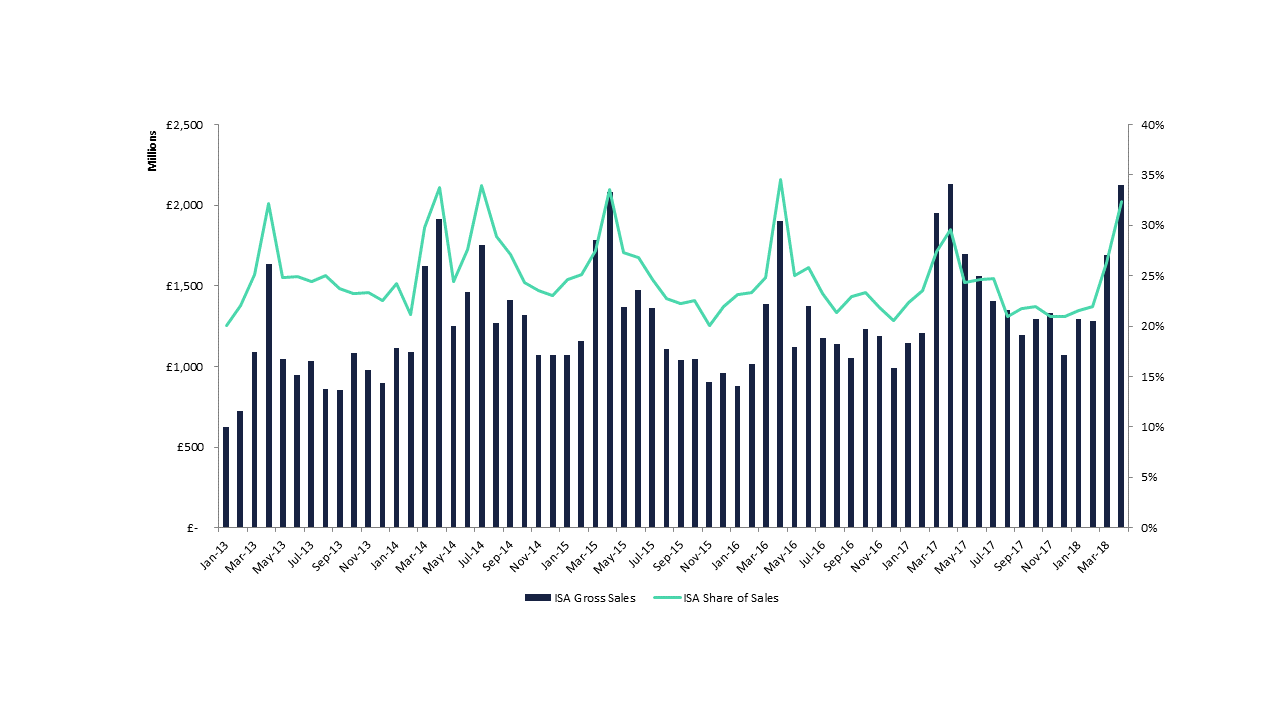

The average returns on a Stocks and Shares ISA recently hit 13 per year. Any individuals aged 18 or over who are resident in the UK are eligible to invest in our Ethical Stocks Shares ISA. Separate figures from the Investment Association IA show that net retail sales of ethical funds were 101m in June 2018 with ethical funds representing a 13 share of industry funds under management.

The ISA account limit for 20182019 is 20000. In a world of historically low interest rates and rising inflation Stocks and Shares ISAs offer the prospect of a higher profit over the long term than if the same. A Stocks and Shares ISA is very different to a Cash ISA which is simply a savings account that you dont pay tax on.

And you can even use an ISA to protect your earnings from the taxman. You can use it however you like. In the 201819 tax year this amounts to a maximum of 20000 which you can use on a cash ISA stocks and shares ISA or a combination of both.

You will be given the option of whether you want to invest ethically in any of the four options by selecting Ethical investments. You can do it through an app. Ethical ISAs Stocks Shares Investment ISAs.

With a Stocks and Shares ISA you are investing your money. The OneFamily Ethical Stocks Shares ISA invests into one fund the Family Charities Ethical Trust which in turn invest directly into large companies in the UK rather than other funds like other model portfolios on this list. Click for more information on.

Brookfields stock has been growing fairly consistently in 2019 and with a 65 yield this is definitely one to watch for ethical investors. In 201819 112 million ISA accounts including 24 million Stocks and Shares ISAs were paid into 1. Start investing ethically with a Stocks and Shares ISA Its now ridiculously easy to get started with ethical investing.

Ethical stocks and shares Isas Several providers offer ethical stocks and shares Isas which they ensure are only invested in companies that meet a. A total of 115 million shares were issued to 62016 individuals and corporate investors which represented 1362 of the purchase. The minimum initial investment amount is 1000 per fund or you can top up from 500.

They were introduced in 2016 to make it easier to invest tax-free with a wider range of providers. A stocks shares ISA also known as an investment ISA is an Individual Savings Account in which you can hold investments in a wide range of shares funds trusts and bonds. Start a new ethical stocks and shares ISA or transfer existing ISAs and achieve your financial objectives while having a positive impact on the planet.

At the time of writing the available options are the large-cap focused Triodos Global Equities Impact fund the. The benefit of a stocks shares ISA is that you wont have to pay tax on the money you earn from your investments. You can do it without picking individual shares.

Wealthify Junior stocks and shares Junior Isa. ISAs preferred shares were listed on the three Colombian exchanges and trading began on February 9 2001. An ethical ISA is a Stocks and Shares ISA account that invests in funds that are managed in line with a particular ethical investment strategy.

When you open an account you first have to choose between a Wealthify Stocks and Shares investment ISA general investment account a Wealthify Junior Stocks and Shares ISA or a Weathify Pension. But despite this popularity Stocks and Shares ISAs also known as Investment ISAs can remain a bit of a mystery to many savers.

Nutmeg Review Is Nutmeg Investing A Good Match For You

Komentar